Are you searching for a reliable and efficient investment platform that simplifies your financial journey? Look no further! In this comprehensive M1 Finance review, we will delve into the world of smart investing and explore the key features and benefits that make M1 Finance stand out from the crowd.

Whether you’re a seasoned investor or just starting your financial journey, M1 Finance offers a user-friendly interface, customizable portfolios, and automated investing tools that can help you achieve your financial goals. Furthermore, M1 Finance is the app that we personally use every single week to invest money into the stock market and strive towards our wealth-building goals.

At His and Her Money, we believe in providing you with the most detailed and informative content. Moreover, we are here to help you make informed decisions about your financial future. In this M1 Finance Review, we will explore the key features, benefits, and advantages of M1 Finance. Additionally, we will demonstrate how it can empower your financial journey.

M1 Finance Review

Are you ready to embark on an investment journey that combines simplicity, automation, and flexibility? In this section, we will provide an in-depth M1 Finance review, covering its features, benefits, and overall user experience.

M1 Finance: Empowering Investors for Success

M1 Finance is an innovative investment platform that offers a unique blend of technology and personal finance. With M1 Finance, you have the power to create your investment portfolio tailored to your financial goals. Moreover, the platform provides a seamless and intuitive interface that enables you to automate your investments, rebalance your portfolio, and monitor your progress effortlessly.

Key Features of M1 Finance

1. Intelligent Automation

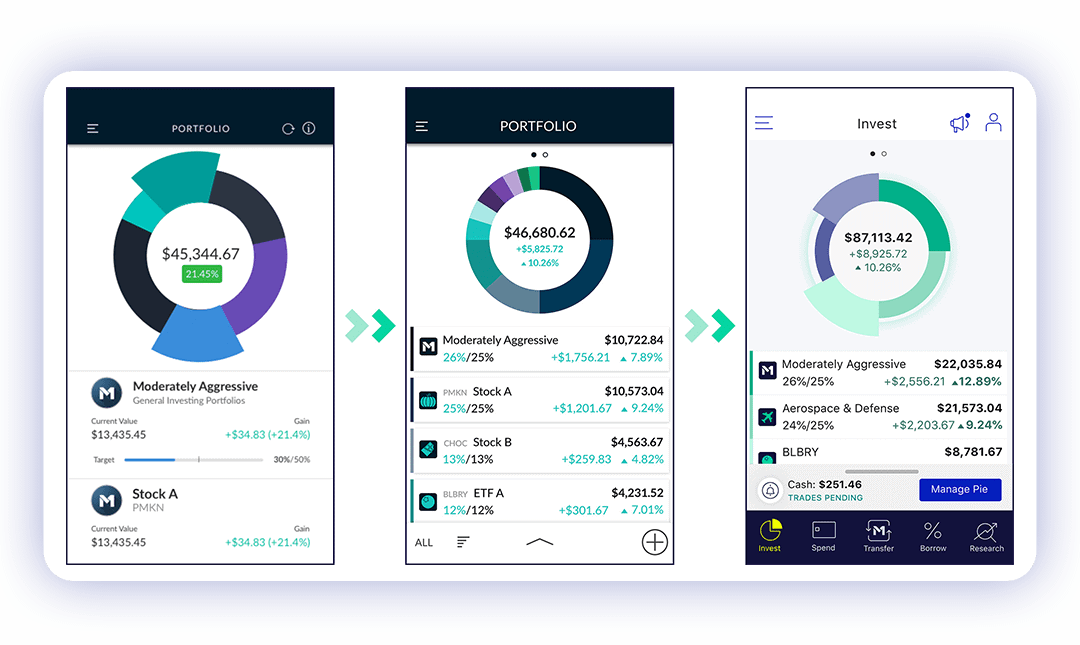

M1 Finance sets itself apart by leveraging intelligent automation to streamline your investment strategy. Moreover, with their revolutionary “Pies” system, you can create customized portfolios tailored to your financial goals and risk tolerance. These Pies are a visual representation of your asset allocation, allowing you to easily visualize and adjust your investments.

2. Fractional Shares

The time when you had to purchase entire shares of stock is long gone. Additionally, M1 Finance provides fractional shares, enabling you to invest as little as $1 in expensive stocks or ETFs. This opens up a world of opportunities and makes it possible for you to create a broad portfolio even with a small budget.

3. Dynamic Rebalancing

Maintaining the desired asset allocation in your portfolio can be time-consuming and challenging. Furthermore, M1 Finance takes care of this for you through its dynamic rebalancing feature. As you contribute or withdraw funds, M1 Finance automatically adjusts your portfolio to keep it in line with your target allocation.

4. Smart Transfer

Transferring funds between your investment and bank accounts has never been easier. Moreover, M1 Finance’s Smart Transfer functionality optimizes your cash flow by intelligently moving money between accounts, ensuring that your investments always work for you.

5. M1 Borrow

Need quick access to cash without disrupting your investment strategy? Furthermore, M1 Borrow allows you to borrow against your portfolio at low-interest rates, providing a flexible and cost-effective solution for your financial needs.

The Benefits of Using M1 Finance

1. Simplicity and Convenience

M1 Finance simplifies the investment process by offering a comprehensive platform that integrates all aspects of your financial life. Additionally, say goodbye to managing multiple accounts and juggling between different platforms; M1 Finance brings everything together in one place, giving you a clear and concise overview of your finances.

2. Customization and Control

You have total control over your investment strategy while working with M1 Finance. Additionally, M1 Finance adjusts to your needs whether you choose a hands-on approach or want to set it and forget it. Numerous investment options are available, including individual stocks, ETFs, and finely constructed Pies.

3. Cost-Effective Investing

Traditional investment platforms often charge high fees, eating into your returns. Moreover, M1 Finance breaks this barrier by offering commission-free trading and no management fees for most accounts. This means more money stays in your pocket, allowing your investments to grow unhindered.

4. Community and Learning

M1 Finance fosters a vibrant and engaged community of investors. Additionally, through their platform, you can connect with like-minded individuals, share insights, and learn from experienced investors. This sense of community enhances your financial knowledge and empowers you to make better investment decisions.

Getting Started with M1 Finance

M1 Finance makes investing accessible and user-friendly for investors of all levels. If you’re new to investing or considering M1 Finance as your investment platform, follow these simple steps to get started:

Step 1: Sign Up for an Account

Visit the M1 Finance website and click on the “Sign Up” button to create your account. Provide the required information, including your name, email address, and password. Additionally, M1 Finance prioritizes the security of your account, ensuring that your personal information is protected.

Step 2: Set Up Your Financial Goals

Upon signing up, you’ll have the opportunity to define your financial goals. Whether it’s saving for retirement, a down payment on a house, or a dream vacation, M1 Finance allows you to set specific targets. Furthermore, this step helps M1 Finance tailor their recommendations to align with your objectives.

Step 3: Choose Your Investment Strategy

With a variety of investment solutions, M1 Finance can accommodate your preferences and level of risk tolerance. Spend some time investigating the possibilities, which include individual stocks, ETFs, and ready-made expert Pies. Additionally, take into account your investing horizon, risk tolerance, and desired level of involvement in portfolio management.

Step 4: Create Your Portfolio

Once you’ve decided on your investment strategy, creating your portfolio is time. M1 Finance’s intuitive interface allows you to build a portfolio with ease. Additionally, you can allocate your funds across different investments, including individual stocks and ETFs, and specify the desired percentage for each holding.

Step 5: Fund Your Account

To start investing with M1 Finance, you’ll need to fund your account. You can do this by linking your bank account to M1 Finance and transferring funds. Once your account is funded, you can start putting your investment strategy into action.

Step 6: Automate and Monitor

One of the key advantages of M1 Finance is its automation features. Take advantage of the platform’s automatic rebalancing and reinvestment to keep your portfolio aligned with your target allocation. Additionally, monitor your investments regularly to stay informed about market trends and adjust your strategy if necessary.

Step 7: Explore Additional Features

As you become more familiar with M1 Finance, take the time to explore its additional features. This includes Smart Transfer, which optimizes your cash flow between your investment and bank accounts, and M1 Borrow, which allows you to borrow against your portfolio. Moreover, these features can further enhance your financial management and flexibility.

FAQs about M1 Finance

- Can I open an M1 Finance account if I am not a U.S. resident? Absolutely! M1 Finance welcomes non-U.S. residents to open investment accounts. However, please note that there are specific requirements and restrictions depending on your country of residence. It’s advisable to check M1 Finance’s official website or contact their customer support for detailed information.

- Is M1 Finance suitable for beginner investors? Yes, M1 Finance is an excellent platform for beginner investors. Its user-friendly interface, automated investing tools, and expertly designed portfolios make it easy for beginners to start their investment journey with confidence. Moreover, M1 Finance offers educational resources and guidance to help investors understand the fundamentals of investing.

- Are there any account minimums or fees with M1 Finance? M1 Finance has no minimum account balance requirements, making it accessible for investors with varying budgets. Additionally, M1 Finance does not charge any trading fees or commissions for its basic services. However, there may be fees associated with specific premium features or optional services, so it’s important to review M1 Finance’s fee schedule for detailed information.

- Can I transfer my existing investment accounts to M1 Finance? Yes, M1 Finance allows you to transfer your existing investment accounts, including Individual Retirement Accounts (IRAs) and taxable brokerage accounts. Furthermore, the platform provides a seamless transfer process and offers step-by-step guidance to ensure a hassle-free transition.

- Is M1 Finance safe and secure? M1 Finance takes the security of your personal and financial information seriously. The platform utilizes advanced encryption and security measures to protect your data. Additionally, M1 Finance is a member of the Securities Investor Protection Corporation (SIPC), which provides protection for your investment accounts up to $500,000.

- Can I access customer support if I have questions or issues? Absolutely! M1 Finance offers customer support via email and phone to assist you with any inquiries or concerns you may have. Also, their support team is responsive and knowledgeable, ensuring that you receive the assistance you need promptly.

Conclusion

Congratulations! You now have a step-by-step guide to get started investing with M1 Finance. Whether you’re a beginner or an experienced investor, M1 Finance offers a user-friendly platform to help you achieve your financial goals.

By following these steps and leveraging the platform’s features, you’ll be on your way to building a successful investment portfolio with M1 Finance. Start your investment journey today and reap the benefits of M1 Finance’s innovative approach to personal finance. We hope that this M1 Finance Review helps you on your journey to wealth building!