*This post is sponsored by Serve ®. All opinions are 100% my own.

The right tools can make all the difference when managing your finances.

But there are seemingly countless options available. With that, it can be tricky to sort out which ones will actually help to organize your finances. Luckily, we are diving into the top five tools you should take advantage of to manage your finances more efficiently.

Let’s dive right in!

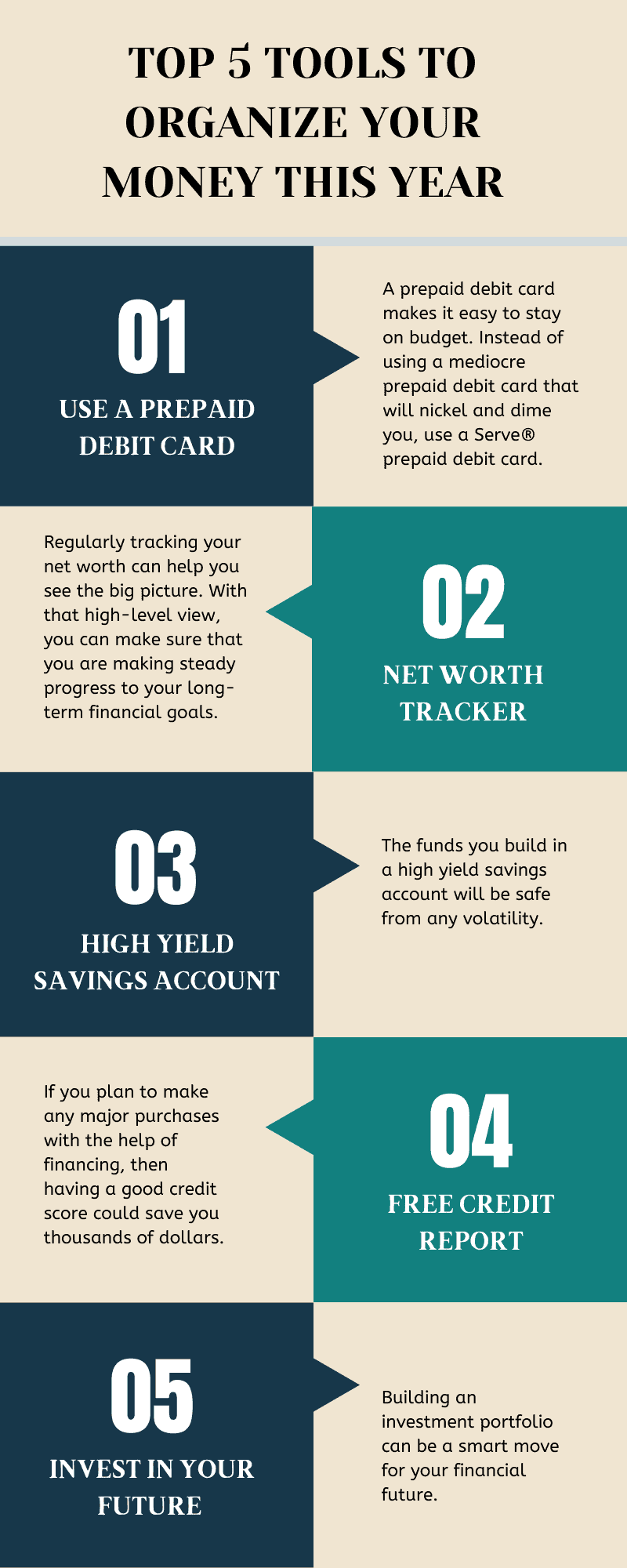

Top 5 tools to organize your money this year

Organizing your money management practices can help you save both time and money. It may take a few minutes to set up these money management tools. But the result will be a financial system that you can manage seamlessly throughout the year.

Who doesn’t want to have the finances streamlined to reduce stress? With a little bit of financial organization, you can create more time to focus on other things that matter to you.

Here are the top 5 tools you should consider using to organize your money this year.

Use a prepaid debit card

The most important place to start is using a tool that can help to get your spending under control. Without a firm handle on your spending, it can be next to impossible to achieve your financial goals.

The good news is that a prepaid debit card makes it easy to stay on budget.

But not just any prepaid debit card will do. If you are looking for a prepaid debit card that gives you the freedom to spend when and where you want, use the Serve® Pay As You Go Visa® Prepaid Card.

You won’t find any minimum balance requirements or hidden fees when working with Serve.

Ultimately, using the Serve Pay As You Go Visa Prepaid Card can help you streamline your money management. Serve offers a suite of features, including:

- Early direct deposit. You can set up Direct Deposit to your Serve card. Depending on your employer, you could receive your paycheck two days early.

- Set goals. Use Goals to set aside funds in your account for a big purchase.

- Mobile friendly. You can check your balance, monitor activities, get text alerts, and send money from your phone.

- Easily load cash. Serve allows you to load cash at thousands of locations.

- Fraud protection. Use this tool without fear of fraud liabilities.

- Customer service when you need it. You can reach out to Serve with questions 24/7.

- No credit check is required. The prepaid debit card doesn’t come with a credit check.

Why not implement this tool into your money management strategy?

Net worth tracker

Staying on top of your spending is critical. But without a bird’s eye view, it can be easy to lose sight of the forest through the trees.

Regularly tracking your net worth can help you see the big picture. With that high-level view, you can make sure that you are making steady progress to your long-term financial goals.

How you decide to track your net worth is up to you. Some prefer a robust financial app that pulls in data from all of your accounts. Others prefer a simple spreadsheet. There is no right or wrong way to track your net worth. But find the right tracker tool that works for you and check in on a regular basis.

High yield savings account

Saving money is a smart move. But where you place those savings can make a big difference.

Whether you are saving for a big goal like retirement or a small goal like your next vacation, take advantage of a high yield savings account. The funds you build in a high yield savings account will be safe from any volatility. But you’ll be able to put your funds to work for you by earning interest until you are ready to spend the savings.

Take the time to explore the available APYs. You might be surprised by the offers out there!

Free credit report

A credit score is a three-digit number that can significantly impact your life. Any time you want to make a major purchase with financing, a lender will check your credit score before committing.

If you plan to make any major purchases with the help of financing, then having a good credit score could save you thousands of dollars. Not to mention the fact that a good credit score can unlock financing opportunities in the first place.

Instead of waiting until you are ready to make your next big purchase, like a house or vehicle, it is a good idea to check out your credit report now. Read over your report to ensure all of the information is correct. If you spot any errors, you may be able to boost your credit score by removing the issues.

The best part is that you can check your credit report for free at AnnualCreditReport.com. Take a few minutes to ensure your credit report is accurate to prepare for any major purchases this year!

Invest in your future

Building an investment portfolio can be a smart move for your financial future. You’ve likely heard this advice before. But this is the year to take action.

You can build wealth with a long-term investment outlook. With that, investing should absolutely be a priority for your financial organization this year. To get started, decide how much you are able to invest and what your portfolio goals are.

If you need help building a portfolio, that’s understandable! Luckily, there are plenty of investment apps and services are designed to help you build an investment portfolio that aligns

with your goals. When choosing a service or app, look for an option that offers low fees and easy-to-navigate features.

How to make these tools work for you

Each of these financial tools can help you organize your money this year. Instead of jumping off the deep end with all five tools at once, consider implementing one tool at a time.

Personally, we recommend getting started with Serve’s prepaid debit card. A prepaid debit card is a perfect foundation as you set up your finances for the future. You can get started with

Serve’s prepaid debit card without a credit check and set up your account within minutes.

Once you are enjoying the robust features that Serve has to offer, you can likely manage your spending more easily. From there, we’d recommend moving forward with a net worth tracker to make sure your finances are moving in the right direction.

As you bring these tools together, look for opportunities to automate where possible. But at the very least, this new level of organization should help you keep your finances on track this year.

The bottom line

Taking the time to organize your finances may feel daunting at first. But implementing one tool at a time should help your finances look organized in no time. Take the first step in organizing your finances by giving Serve a try.